#AAPL (Apple Inc.). Exchange rate and online charts

Currency converter

27 Mar 2025 19:27

(-3.7%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

Apple Inc. is the American IT-giant and the most expensive company in the world. Its capitalization exceeds $450 billion and the brand value according to different estimates reaches $98 to $185 billion. The company was established in early 70’s in California by Steve Jobs and Steve Wozniak, and first registered on April 1, 1976. The IPO was launched on December 12, 1980. In total, 4.6 bln securities were sold at the initial cost of $3.6. Until 2004 the share price did not go over $40. However, after the company refocused on the mobile devices, the share price has multiplied by 6 times. Moreover, after the release of the iPad, the shares of Apple Inc. surged to the mark of $700. Now the asset turnover is about 900 billion and the unit price fluctuates around $500.

Apple Inc. share price has been growing by approximately 16.1% for the last three years. The dividend yield equals 2.23% and EPS 42% a year. Cost of securities is directly bound to the quarterly reports and new devices releases. The main income of Apple Inc. is constituted by expanding iPhone sales, which comprise about 67% of gross income. Consequently, the company’s share value is much influenced by the success of new Apple smartphones.

See Also

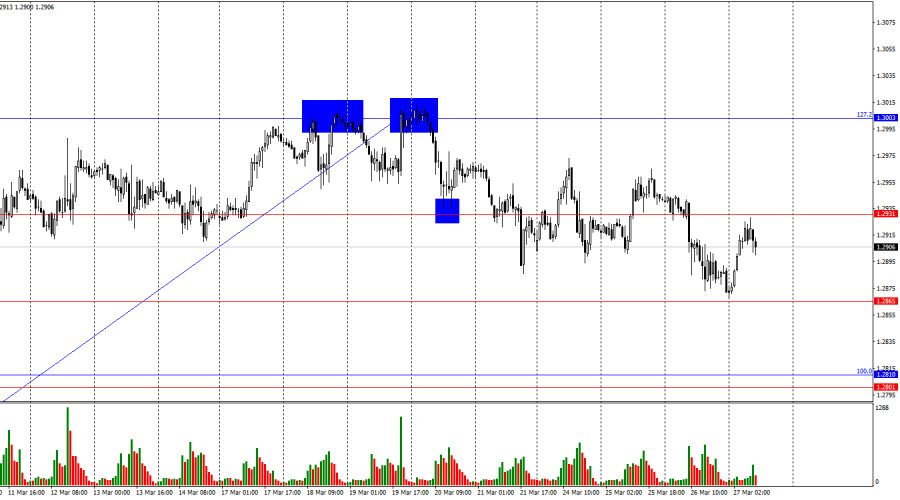

- Bears are starting to tip the scales in their favor

Author: Samir Klishi

11:19 2025-03-27 UTC+2

1960

Fundamental analysisWho Had Any Doubts? Trump Remains Committed to His Economic Course (GBP/USD May Fall, #SPX May Rise)

Despite the ongoing political maneuvering, U.S. President Donald Trump remains committed to his economic strategy. This approach aims to dismantle the long-standing global economic model in which the U.S. primarily produces money while the rest of the world supplies the goodsAuthor: Pati Gani

10:21 2025-03-27 UTC+2

1660

President Donald Trump is reportedly preparing to announce new auto tariffs in the near future. Dollar Tree shares rose following the sale of its Family Dollar business. GameStop stock surged on its Bitcoin bet and stronger fourth-quarter earnings. The Nikkei dropped by 1%.Author: Gleb Frank

12:15 2025-03-27 UTC+2

1660

- Today, the EUR/USD pair is gaining some positive traction, breaking a six-day losing streak.

Author: Irina Yanina

10:58 2025-03-27 UTC+2

1630

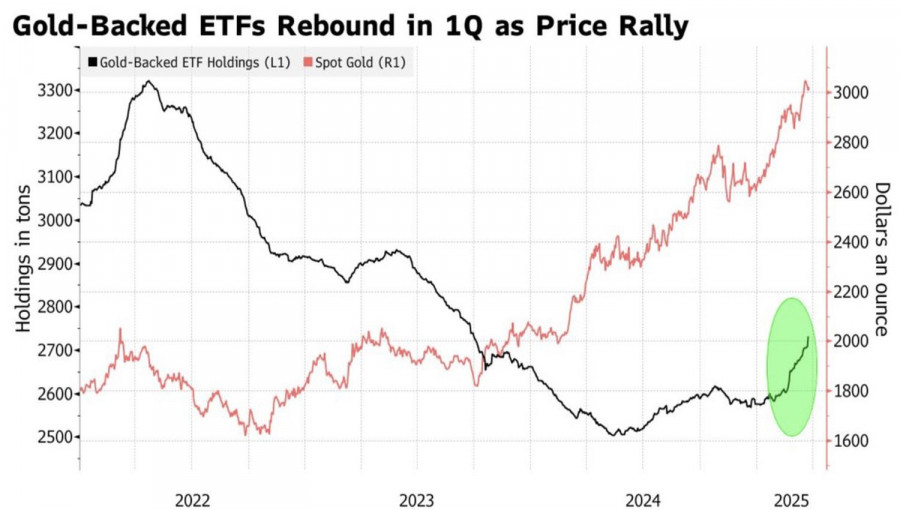

Trade tensions are driving demand for safe-haven assets.Author: Irina Yanina

11:44 2025-03-27 UTC+2

1615

US President Donald Trump imposed 25% tariffs on auto imports, triggering a sharp sell-off in equity markets. The S&P 500 and Nasdaq indices fell as investors grew concerned about escalating trade tensions with Canada, Mexico, and EuropeAuthor: Ekaterina Kiseleva

12:02 2025-03-27 UTC+2

1600

- Technical analysis of EUR/USD, USD/JPY, USDX and Bitcoin

Author: Sebastian Seliga

12:24 2025-03-27 UTC+2

1495

The US crypto regulation bill is progressing rapidly through the legislative process.Author: Jakub Novak

11:52 2025-03-27 UTC+2

1495

Once you understand how the system works, winning isn't hardAuthor: Marek Petkovich

11:55 2025-03-27 UTC+2

1360

- Bears are starting to tip the scales in their favor

Author: Samir Klishi

11:19 2025-03-27 UTC+2

1960

- Fundamental analysis

Who Had Any Doubts? Trump Remains Committed to His Economic Course (GBP/USD May Fall, #SPX May Rise)

Despite the ongoing political maneuvering, U.S. President Donald Trump remains committed to his economic strategy. This approach aims to dismantle the long-standing global economic model in which the U.S. primarily produces money while the rest of the world supplies the goodsAuthor: Pati Gani

10:21 2025-03-27 UTC+2

1660

- President Donald Trump is reportedly preparing to announce new auto tariffs in the near future. Dollar Tree shares rose following the sale of its Family Dollar business. GameStop stock surged on its Bitcoin bet and stronger fourth-quarter earnings. The Nikkei dropped by 1%.

Author: Gleb Frank

12:15 2025-03-27 UTC+2

1660

- Today, the EUR/USD pair is gaining some positive traction, breaking a six-day losing streak.

Author: Irina Yanina

10:58 2025-03-27 UTC+2

1630

- Trade tensions are driving demand for safe-haven assets.

Author: Irina Yanina

11:44 2025-03-27 UTC+2

1615

- US President Donald Trump imposed 25% tariffs on auto imports, triggering a sharp sell-off in equity markets. The S&P 500 and Nasdaq indices fell as investors grew concerned about escalating trade tensions with Canada, Mexico, and Europe

Author: Ekaterina Kiseleva

12:02 2025-03-27 UTC+2

1600

- Technical analysis of EUR/USD, USD/JPY, USDX and Bitcoin

Author: Sebastian Seliga

12:24 2025-03-27 UTC+2

1495

- The US crypto regulation bill is progressing rapidly through the legislative process.

Author: Jakub Novak

11:52 2025-03-27 UTC+2

1495

- Once you understand how the system works, winning isn't hard

Author: Marek Petkovich

11:55 2025-03-27 UTC+2

1360