Trade Review and Recommendations for the British Pound

The price test of 1.3077 occurred at a time when the MACD indicator had already moved significantly below the zero line, which limited the pair's further downward potential.

Following recent remarks by Donald Trump about negotiating with each country individually, the British pound posted a sharp decline. This statement creates additional obstacles for the negotiation process, which UK authorities had hoped would gain momentum after the imposition of tariffs. The market reacted immediately: investors, concerned about the outlook for the British economy under fragmented trade agreements, began actively offloading pound-denominated assets. Trump's stance casts doubt not only on the future of UK–US trade relations but also on the overall stability of global trade. Individual negotiations are likely to create room for protectionist measures and heightened competition among nations, ultimately having a negative impact on the global economy.

The upcoming Nonfarm Payrolls report and the U.S. unemployment rate are the key data to watch in the second half of the day. Around the middle of the U.S. session, Federal Reserve Chair Jerome Powell is expected to speak. He will likely comment on the newly imposed U.S. tariffs against major trade partners. This event could trigger increased dollar volatility as market participants closely examine any signs of shifts in monetary policy.

For intraday strategy, I will rely primarily on the execution of Scenarios #1 and #2.

Buy Signal

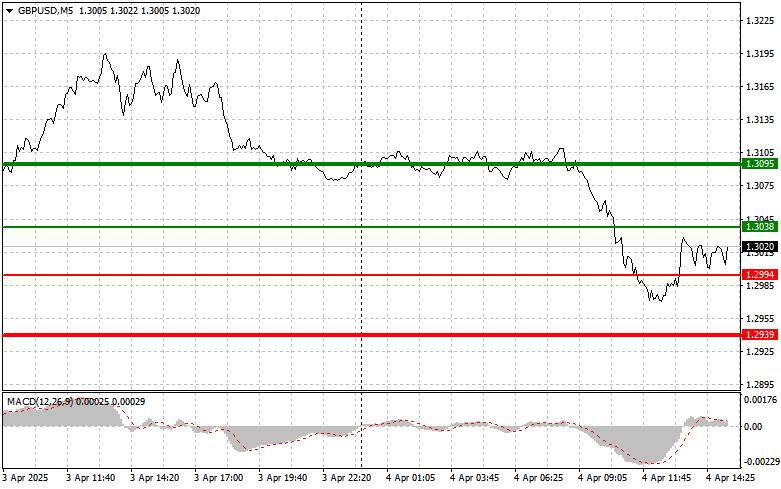

Scenario #1: I plan to buy the pound today upon reaching the entry point near 1.3038 (green line on the chart), with a target of rising toward 1.3095 (thicker green line). Around 1.3095, I will exit long positions and open short ones, anticipating a 30–35 point pullback from that level. A continuation of the pound's upward trend can be expected today. Important: Before buying, make sure that the MACD indicator is above the zero line and just starting to rise from it.

Scenario #2: I also plan to buy the pound in case of two consecutive tests of the 1.2994 price level, when the MACD indicator is in the oversold zone. This will limit the downward potential and trigger a reversal to the upside. Growth to the opposing levels of 1.3038 and 1.3095 can be expected.

Sell Signal

Scenario #1: I plan to sell the pound after a break below 1.2994 (red line on the chart), which will likely trigger a sharp drop. The main target for sellers will be 1.2939, where I will exit short positions and immediately open long ones in the opposite direction (anticipating a 20–25 point rebound from that level). Sellers are expected to become active if the U.S. employment data is strong. Important: Before selling, make sure that the MACD indicator is below the zero line and just starting to decline from it.

Scenario #2: I also plan to sell the pound today in case of two consecutive tests of the 1.3038 level, when the MACD indicator is in the overbought zone. This will limit the pair's upward potential and trigger a reversal to the downside. A decline to 1.2994 and 1.2939 can be expected.

On the Chart:

- Thin green line – entry price to buy the trading instrument;

- Thick green line – estimated level to place Take Profit or manually close profits, as further growth above this level is unlikely;

- Thin red line – entry price to sell the trading instrument;

- Thick red line – estimated level to place Take Profit or manually close profits, as further decline below this level is unlikely;

- MACD Indicator – when entering the market, it is essential to monitor overbought and oversold zones.

Important:

Beginner Forex traders should be extremely cautious when entering the market. It is best to remain out of the market before the release of major fundamental reports to avoid sharp price fluctuations. If you choose to trade during news events, always place stop-loss orders to limit potential losses. Trading without stop-losses can lead to the rapid loss of your entire deposit, especially if you don't use money management and trade with large volumes.

And remember: successful trading requires a clear trading plan, like the one presented above. Spontaneous decision-making based on current market sentiment is an inherently losing strategy for intraday traders.