GBP/USD 5-Minute Analysis

The GBP/USD pair experienced a sharp decline of nearly 200 pips on Wednesday. Notably, there were no clear local factors to explain such a significant drop in the pound. There were no relevant reports released in the UK, and the U.S. data suggested a weakness in the dollar. However, before the U.S. data were unveiled, GBP/USD had already fallen by 165 pips, with the ADP report only managing to temporarily halt the decline. The pair has broken its last local low, indicating that the downtrend is likely to continue.

From the beginning, we warned that any rise in the euro or the pound during a strong downtrend should be regarded merely as a correction. As we observed, even the recent breach of the Ichimoku indicator lines did not alter market sentiment. Instead, traders used the rebound as an opportunity to open short positions at more favorable levels, consistent with the broader trend. We have consistently stated that the pound is overbought and unjustifiably expensive, reflecting a downtrend that has persisted for 16 years. The monetary policies of the Bank of England and the Federal Reserve, which we discuss in every analysis, further support this perspective. Thus, there is nothing surprising about Wednesday's sell-off of the pound.

On Wednesday, only one trading signal was generated. Unfortunately, two levels and the Kijun-sen line coincided in the formation area. As a result, we had to wait for all these levels to be broken before entering a short position. Nevertheless, even with this delay, the short trade produced a profit of at least 60 pips. It is unfortunate that the signal wasn't generated earlier, as this could have led to significantly higher profits. Around the 1.2349 level, the price fluctuated above and below without establishing a clear signal in that region.

COT Report

The Commitments of Traders (COT) reports for the British pound indicate that the sentiment of commercial traders has been highly volatile in recent years. The red and blue lines, representing the net positions of commercial and non-commercial traders, frequently intersect and generally hover near the zero mark. On the weekly timeframe, the price initially broke below the 1.3154 level and subsequently moved down to the trendline, which it breached this week. This breach of the trendline strongly suggests that the pound's decline is likely to continue.

According to the latest COT report, the "non-commercial" group closed 3,700 buy contracts and 1,400 sell contracts. As a result, the net position of non-commercial traders decreased by 2,300 contracts over the week.

The current fundamental outlook does not support any long-term purchases of the British pound. The currency seems likely to continue its global downtrend. Consequently, the net position may keep declining, indicating a reduced demand for the pound sterling.

GBP/USD 1-Hour Analysis

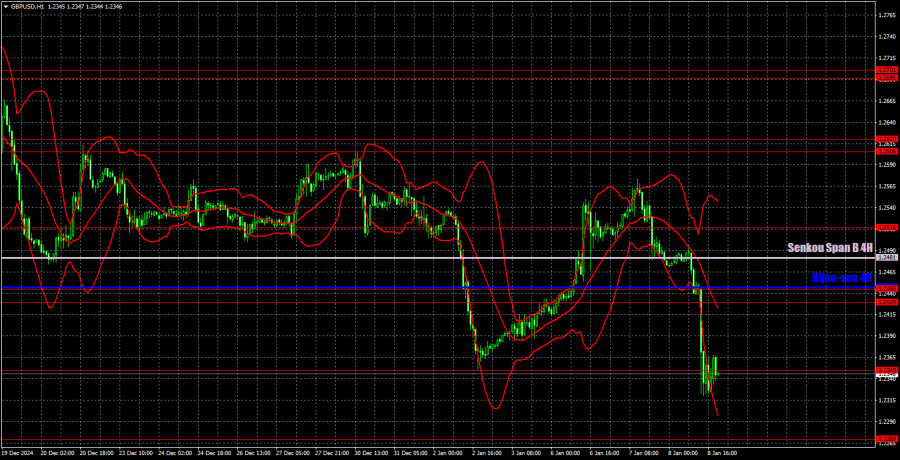

On the hourly timeframe, GBP/USD continues to show a bearish trend, with the recent corrective movement coming to an end quickly. We see no fundamental reasons for the pound to rise, apart from occasional technical corrections. In the medium term, we anticipate that the pound will decline further. There is a possibility of a flat phase, especially if the pair does not continue its downward movement today and if U.S. macroeconomic data released on Friday is disappointing.

For January 9, the following key levels are identified: 1.2269, 1.2349, 1.2429-1.2445, 1.2516, 1.2605-1.2620, 1.2691-1.2701, 1.2796-1.2816, and 1.2863. The Senkou Span B (1.2481) and Kijun-sen (1.2447) lines can also serve as potential signal points. A Stop Loss should be set at breakeven once the price moves 20 pips in your favor. Ichimoku indicator lines may shift during the day, which should be factored into signal determination.

There are no significant events scheduled in the UK or the U.S. on Thursday, which could allow the pound to avoid another sharp decline. If it manages to stabilize, a flat phase may develop. However, we currently believe that a continuation of the downtrend is much more likely.

Illustration Explanations:

- Support and Resistance Levels (thick red lines): Thick red lines indicate where movement may come to an end. Please note that these lines are not sources of trading signals.

- Kijun-sen and Senkou Span B Lines: Ichimoku indicator lines transferred from the 4-hour timeframe to the hourly timeframe. These are strong lines.

- Extreme Levels (thin red lines): Thin red lines where the price has previously bounced. These serve as sources of trading signals.

- Yellow Lines: Trendlines, trend channels, or any other technical patterns.

- Indicator 1 on COT Charts: Represents the net position size for each category of traders.